April 2022

“The thing about climate is that you can either be overwhelmed by the complexity of the problem or fall in love with the creativity of the solutions.”

– Mary Heglar,

Climate writer and co-host of Hot Take podcast

“The thing about climate is that you can either be overwhelmed by the complexity of the problem or fall in love with the creativity of the solutions.”

– Mary Heglar,

Climate writer and co-host of Hot Take podcast

“We must become independent from Russian oil, coal and gas. We simply cannot rely on a supplier who explicitly threatens us.”

As we review the news of the last month, we’d like to shine a light on something that is too often ignored by the prognosticators…

Dear Friends,

In January the biggest front-page, top-of-the-hour news of the natural world was the undersea volcano eruption near the Tongan islands and the subsequent tsunamis, falling ash, and devastation. Unlike some past eruptions, this one does not appear to have sent enough reflective material into the upper atmosphere to cool the planet and give us even a short reprieve from rising temperatures.

As for man-made news, tensions between Russia, Ukraine, and their allies are erupting as well. Not that he’s asking us, but perhaps President Vladimir Putin might do well to focus on the threats coming from the northeastern part of his country, not neighbors to the west. We aren’t foreign policy experts, but what is happening to his country’s permafrost could be far more unsettling – over the long term – to the country’s economy and stability than the sovereignty of Ukraine.

While not as visually arresting as an explosion in the South Pacific or the amassing of armed forces, the thawing permafrost is very bad news. Two-thirds of Russia’s landmass is considered permafrost – land that never thaws even in the summer – but climate change is causing it to thaw rapidly. This makes the ground soften and buckle, threatening critical infrastructure like roads, cities, and oil and gas pipelines across Siberia. And to top it off, vast stores of greenhouse gases like CO2 and methane – that used to be frozen in the ground – are being released, joining man-made emissions in the atmosphere.

Eruptions, conflict, and a 24/7 news cycle make it easy to get distracted, and depressed. But we need to keep our focus on the long term trends as well: not only the slow-rolling threat of our warming planet but also the growing supply of creative and sustained solutions.

Like crocuses poking through the snow, climate and energy innovations are coming. We remain determined and hopeful, and know that you will too.

Warmly,

The C-Change Conversations Team

“Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead, or will you be led?”

-Larry Fink, Chairman and CEO, Blackrock in his annual letter to investors

2021 clocked in as the sixth warmest year ever measured according to three reliable monitors of atmospheric temperatures (NOAA, NASA, and Berkeley Earth). That might sound like improvement – we missed the top five, after all. But scientists tell us there’s no good news here. To the contrary, the sixth hottest year ever was replete with a slew of countervailing record-setting events we’d rather not have seen.

For starters, ocean temperatures broke all time heat records for the third year in a row with grim consequences for today and tomorrow. Marine heat waves threaten ocean species, contribute to sea-level rise, and fuel stronger hurricanes and other extreme weather events.

Indeed, heavy weather was a hallmark of last year and 2021 witnessed a relentless series of climate disasters all across the globe. From last June’s asphalt-melting heat wave in America’s Pacific Northwest to triple digit temperatures in the Arctic, some two billion people experienced unprecedented local temperatures.

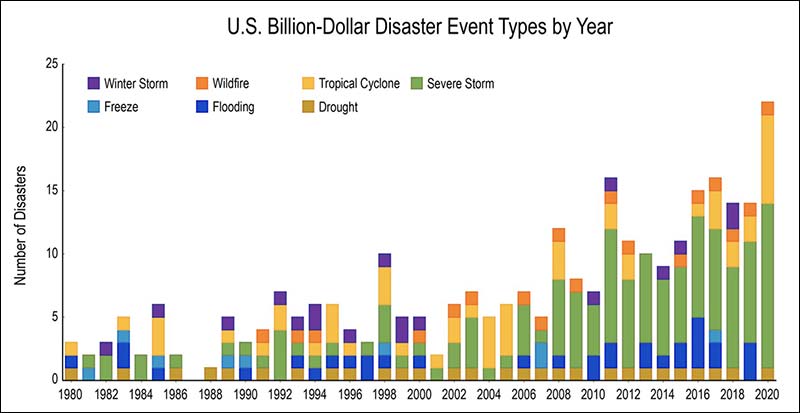

The financial pain of these and other records is being felt right here, right now. Last year ranked number two for the U.S. in the number of billion dollar climate disasters we endured.

In light of all this, it’s distressing to see that our CO2 emissions reversed years of incremental decline to surge back in 2021 toward pre-pandemic levels. A report by the Rhodium Group says the cause was freight transportation (primarily on roads) and coal-fired power generation, which jumped 17 per cent – the first increase in coal-fired power generation since 2014.

January, however, brought other cyclical reports, too – notably the annual letter to investors from BlackRock CEO Larry Fink. The influential money manager has focused on climate change for quite some time. But this year he made one of the strongest free-market cases to date for private sector leadership in addressing rising global temperatures. His letter stressed that long-term returns rather than politics motivate his company’s investment agenda and asked others to consider the costs of lagging behind. “As your industry gets transformed by the energy transition,“ he wrote, “will you go the way of the dodo, or will you be a phoenix?”

It’s increasingly clear that Fink represents an emergent consensus among the most future-focused finance and insurance industry planners. In November we told you about the Glasgow Financial Alliance for Net-Zero – a coalition of 450 financial institutions from 45 countries that are mobilizing assets to fight climate change. In January, a new consortium of 19 large banks, including Bank of America, Wells Fargo, and Royal Bank of Canada, announced it is developing consistent frameworks and standards for climate risk management.

Other sectors are feeling the heat, too – though from more defensive postures. Public relations and advertising firms that have helped spread climate disinformation faced calls in an open letter from 450 scientists this month to drop their fossil fuel clients and stop greenwashing their businesses.

On the technology front, we’re intrigued with thinking about electric vehicles in a whole new light. A story in Vox reminds us that EVs are really just large batteries with wheels that can be used “to help prevent blackouts, stabilize the grid, and make solar and wind more reliable sources of energy.”

And one last bit of hopeful – and fun – news: designers around the world are creating windows, shingles, lampshades, tables, jackets, and even purses that can convert the sun’s energy into electricity. The world’s first Solar Biennale will showcase these and other recent inventions in Rotterdam, Netherlands this fall.

Solar energy! It’s not just for panels any more.

Speaking of the sun, here’s a way to “warm up” no matter where you live. Take this 9-question quiz from our trusted friends at NASA.

Dear Friends,

All of us at C-Change Conversations wish you a very happy, healthy holiday season.

What does C-Change Conversations want for 2022?

Peace, goodwill, and a world that finally gets serious about tackling climate change. So if by chance you cross paths with a vacationing member of Congress or the Administration, we hope you’ll hold their feet to the yule log over global warming!

As we saw at COP26, and recently within the U.S., forging smart policy around climate change is tough. But we’ve got to keep trying to find a way because nature doesn’t take a recess. To the contrary, there is growing evidence that global warming and its negative effects may be more apparent in 2022 than we might expect.

Here’s our monthly roundup of recent news that makes us both concerned and hopeful as we greet the new year. Be sure to read to the end and play a fun game, suitable for tweens and older.

Best,

The C-Change Conversations Team

So ho-ho-ho and all that. Tis the season to be green. But in the words of Mark Carney, a former Goldman Sachs executive and a former governor of both the Bank of Canada and the Bank of England:

“We can’t get to net zero by flipping a green switch. We need to rewire our entire economies.”

Let’s start with the latest science which, fittingly for the holidays, comes from the Earth’s pole – albeit the Southern one.

A highly-regarded international research team announced this month that a cracking Antarctic ice shelf could disintegrate within 3-5 years, starting a chain reaction that would drop a glacier the size of Florida into the Southern Ocean and elevate sea levels as many as two to 10 feet. The increase will happen slowly, beginning in the next decade and accelerating over centuries, but it is a visible reminder we are setting something into motion that we can’t pull back and will change the contours of our coastlines forever.

What would 10 feet of sea level rise mean for the U.S.? Previous surveys have calculated that it would swamp more than 28 thousand square miles of land that is home to over 12 million Americans, including large parts of New York, New Orleans, Miami, Boston, and dozens of other major cities.

Rising sea levels, even at smaller levels, will create a very different world for our children and grandchildren. Climate Central’s ‘Picturing Our Future’ interactive graphics show projected sea level rise in iconic places like the Lincoln Memorial and the Sydney Opera House, demonstrating the likely outcomes if we stay on our current emissions trajectory to a 3℃ increase (5.4℉) by the end of this century or pivot to meet international goals of limiting the rise to 1.5℃ (2.7℉). The differences are stark, underscoring how every degree of increase matters.

The devastation would ripple far beyond the sunken acreage. For the first time, the annual report of the Financial Stability Oversight Council warned that climate change is an ’emerging threat’ to the U.S. financial system [paywall]. It spells out how the growing frequencies of fires, floods, and hurricanes will cascade through the entire economy, threatening the welfare of us all. And The Wall Street Journal became just the latest business-focused entity to warn of trillions of dollarsof stranded assets [paywall] due to rising tides of all kinds – elevated sea levels, to be sure, but also growing demands from investors, insurers, consumers, employees, and regulators for urgent action (see more below).

The drip, drip, drip of melting ice and bad news goes on. Another new study projects that mountainous U.S. states may be nearly snowless for multi-year stretches [paywall] after mid-century if warming doesn’t slow. The resulting loss of snowpack will profoundly disrupt the water supply of much of the American West. Despite all this – and despite all the net-zero pledges we told you about last month – the coal industry is set to experience record highs in 2022, according to the authoritative International Energy Agency. Coal, of course, is one of the dirtiest and most carbon intensive fossil fuels in our energy portfolio.

And, at the risk of overplaying the holiday theme, we’re dropping that coal right into the Christmas stockings of the younger generation – in more ways than one. Yet another new study concludes that children born today are statistically likely to experience seven times more extreme weather events [paywall] than their grandparents.

Is there a silver lining in any of this? Possibly a little. Those stranded assets that we mentioned above are expected to be partly caused by surging demand for change from stakeholders of all kinds. Morgan Stanley reports that interest in sustainable investing has reached new heights despite the economic uncertainty posed by COVID. A staggering 99% of millennials expressed interest in aligning their investment decisions with environmental values. And a new survey shows that 43% of oil and gas company workers want to leave the sector with more than half – 56% – saying they’re considering employment in renewable energy.

It seems they can hardly move fast enough. This month New York – America’s largest city – became the latest urban area to ban natural gas in new buildings. The move is part of a growing push by municipal governments to drive down carbon emissions.

And in other incremental but far-reaching developments, a new executive order is driving the federal government toward carbon neutrality [paywall] by phasing out gas-powered vehicles and using only renewables to fuel its buildings. Also this month, United Airlines made history by flying a passenger aircraft from Chicago to Washington, DC with 100% Sustainable Aviation Fuel (SAF) – renewable biomass or, effectively, recycled cooking oil.

These trends – on top of a range of other phenomena related to climate, economics, and politics – have added up to heavy headwinds for the gas industry. Whereas gas was until recently considered an important ‘bridge’ fuel to a net-zero energy sector, the impetus to move straight to renewables across the entire economy is growing fast.

C-Change urges all of us to call on our elected officials to act. But just how hard is it to get to net-zero? What are the political, financial, and environmental costs?

See for yourself in this fun game. If you win, you’ll go down in history as the most popular carbon-neutral leader of all time. Lose, and you choke on a cloud of smog.

Good luck!

Dear Friends,

As we head into Thanksgiving, it seems fitting to ask whether there’s anything to be thankful for with respect to climate change, especially in the wake of COP26 – the much anticipated global conference that ran into overtime before wrapping up in Glasgow, Scotland on November 13th.

As a quick reminder, the primary goal of COP26 was to keep alive the international community’s hope for capping global warming at 1.5℃ above pre-industrial levels. By that minimal standard, the conference succeeded. Hope is not dead.

At the eleventh hour, nearly 200 nations signed on to a new ‘Glasgow Climate Pact’ that, for the first time, targeted fossil fuels as the key driver of climate change and declared carbon emissions must plummet 45 percent by 2030 to maintain the temperature cap of 1.5℃ degrees – above which climate change impacts are projected to become much worse. It also called on governments to reconvene next year to report stronger plans to curb emissions.

The devil, of course, is in the missing details. Many observers who have focused on those absent specifications are bemoaning a half-empty glass. The commitment on future coal use was watered down at the last minute; climate finance pledges risk remaining empty promises; and negotiators kicked the can down the road a year when it came to mapping out exactly how the world will slash emissions almost in half.

But, but, but. There is much good news coming out of the summit, and C-Change would like to dedicate this newsletter to the full half of the COP26 glass. And use it to toast the holidays.

Because, despite the omissions, Glasgow delivered important accomplishments that would have been unthinkable just a few years ago. The United States and the rest of the world looked at reality and didn’t shut their eyes. COP26 gave us new building blocks for progress, and the march to net-zero is clearly accelerating.

Here are a few reasons to give thanks and raise a glass on Thanksgiving.

All the best,

The C-Change Conversations Team

Transitioning away from fossil fuels is possible. The capital is mobilizing. The technology is ready. And carbon-free energy sectors are growing fast.

How much of the world’s energy comes from sustainable sources right now? 29% has never looked so thrilling as it does at the hands (and feet and wheels) of Danny MacAskill. Taking to the Skies for Climate Change is a video you’ll want to share with holiday guests. The ending alone will have you gasping and cheering!

First, let’s pause to applaud the return of the United States to a leadership role [paywall] on climate. After years of backtracking, Washington is now committing significant financial resources and real diplomatic muscle to get out in front of global warming.

Of note, a delegation of Republicans was active at the climate summit this year. Led by Reps. John Curtis (R-UT) and Garret Graves (R-LA), the group sought to demonstrate conservative leadership to the global community and address Republican and independent voters who favor climate action.

The turnaround began reaping benefits immediately. Most dramatically, the U.S. and China announced a surprise agreement in Glasgow to boost their climate cooperation. The joint pledge by the world’s top two greenhouse gas polluters to take ‘concrete actions’ on emissions was hailed as a highpoint of the two-week conference.

There were other governmental commitments to cheer, as well. 110 nations signed on to a global methane pledge, promising to cut methane emissions by 30% by the end of this decade. (Methane is a greenhouse gas that is 84 times more potent than carbon.) Also by 2030, another 130 countries agreed to end or reverse deforestation.

But the real game changer may well have come from the corporate sector [paywall]. A proof point is the mobilization of $130 trillion in private capital, announced at Glasgow, to accelerate the global transition to a zero emissions economy. Those are the collective assets of the Glasgow Financial Alliance for Net-Zero, a coalition of 450 financial institutions from 45 countries, and they come close to matching the estimated $150 trillion price tag for decarbonizing the world.

Two other Glasgow “game changers” were the announcement of the new International Sustainability Standards Board, which will publish mandatory climate reporting standards by the end of 2022 and provide investors with greater transparency and encourage higher levels of investment, and the long-awaited adoption of rules for a new global carbon market. Some six years in the making, the initiative establishes a framework for how companies and countries can trade carbon emission credits across borders.

Underscoring the observation that COP26 was a high-water mark for business and finance in the climate space …

“Glasgow will be remembered as the turning point when companies from all sectors, en masse, are now turning their attention to developing and driving their decarbonization strategies. It is another big step forward on the pathway towards a net-zero emissions world.”

– Keith Tuffley, Global Co-head of Sustainability and Corporate Transitions, Citigroup Inc.

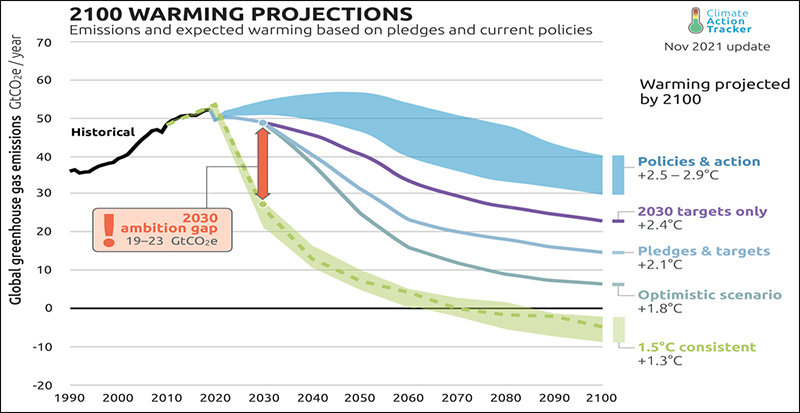

And with our Thanksgiving toasts, perhaps a little prayer. Although hope is not dead, it is hanging by a thread, as indicated by the Climate Action Tracker’s chart below. According to its calculations, before COP26, policies in place around the world were projected to result in warming between a 2.5-2.9℃ increase (4.5-5℉) above pre-industrial levels. New pledges for long-term binding and net-zero targets, if enacted, would bring us to a 2.1℃ increase (almost 4℉), better, but still significantly above the goal of keeping the increase to 1.5℃ (2.7℉).

Countries still need to do a lot more to reach the bottom line in the chart. Next year’s COP27 in Cairo, Egypt will be the reckoning.

Dear Friends,

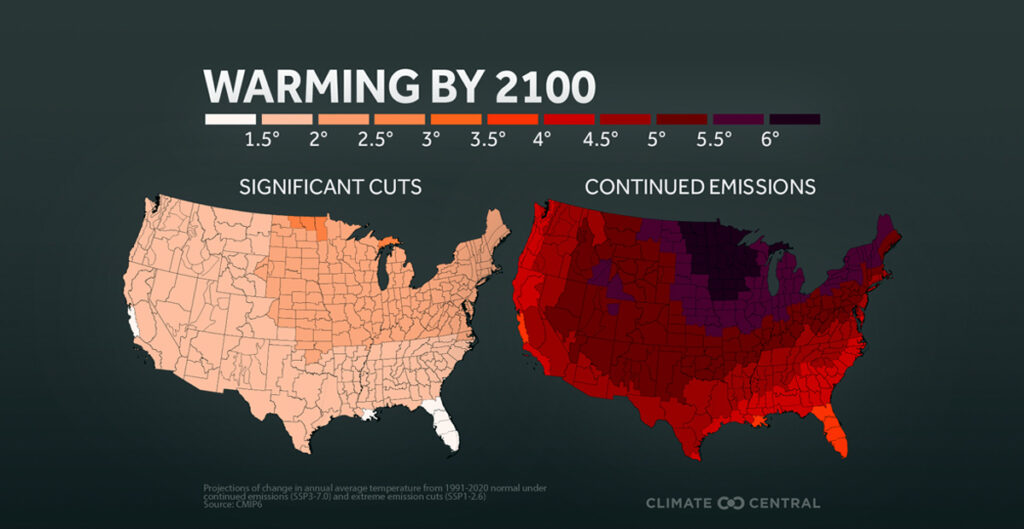

The 2021 international conference on climate change is underway in Glasgow, Scotland. It’s a tense moment. Nations have convened annually for 25 years but this year’s meeting is particularly urgent because it is the deadline for countries to present their plans to cut greenhouse gas emissions enough to keep planetary warming below 1.5℃. If the parties fail to achieve the necessary reductions, the world will blow past that cap and face severe consequences. Scroll down for a compelling graphic that shows what this could mean for the continental United States.

Success won’t be easy. With national negotiators facing glaringly high political and financial hurdles – and with target pledges so easily missed – October saw plenty of bleak forecasts for curtailing greenhouse gas emissions. But that’s not the whole story. October also saw human ingenuity in overdrive. From the U.S. military to U.S. farmers, entrepreneurs, and technologists – and including innovators around the world – we take heart in the emergence of ideas, startups, and prototypes that might have sounded like plots for a new Iron Man movie just a few years ago.

Fueling jet planes from thin air? Race cars running on low-carbon fuel? It may happen sooner than you think. And those are just two of the ideas under development right now, right here. None of them is a silver bullet. Not all will work. But taken together – and sitting on top of enormous strides already made in renewable energy, batteries, and other climate solutions – we’ve rarely felt better about the prospects for thriving in a low-carbon world.

Warmly,

The C-Change Conversations Team

“A Swiss startup has created a giant vacuum cleaner to capture carbon dioxide from the air, helping companies offset their emissions. WSJ visits the facility to see how it traps the gas for sale to clients like Coca-Cola, which uses it in fizzy drinks.” – The Wall Street Journal, October 19, 2021

“It doesn’t matter if you believe in climate change; your insurance company does.”

– Nick VinZant, senior research analyst for QuoteWizard, a subsidiary of Lending Tree, the online mortgage company

Let’s face up to the bad news first. The United Nations released a study a few days ago assessing the cumulative impact of all the existing national climate pledges, and the bottom line isn’t good. Collectively, the various promises to cut national emissions add up to just one-seventh of cuts needed [paywall] to stay on the safe side of global warming.

Promises by industrialized countries to support clean energy development in poorer nations also seem to be falling dangerously short. Heading into the Glasgow COP26 summit – and complicating its resolution – 48 countries from ‘The Climate Vulnerability Forum’ are demanding that richer nations meet and now exceed existing promises to provide $100 billion in climate aid yearly. Many commentators worry that the rising costs of buying cooperation will hobble the negotiations.

That’s troubling, especially since evidence is growing daily that climate change is affecting almost everyone and every nation right now, be they rich or poor. New research calculates that 85% of the world’s population already has direct, lived experiences with climate disasters [paywall]. And those disasters have reached 80% of the globe’s land mass.

Despite all the obstacles – including a fair dose of skepticism – it’s hard not to applaud other developments in the climate space. First, let’s pause to praise some surprising new voices in the climate awareness choir. The United Arab Emirates and Saudi Arabia – two major oil exporting nations – have declared net-zero intentions by 2050 and 2060, respectively. And we hear that even natural gas producer Russia is considering a net-zero announcement at the Glasgow summit. By putting their countries’ long-term future ahead of their current income streams, these fossil fuel giants seem to be accepting the need to transition to renewable energy sources.

Few new choristers are more surprising, however, than Report Murdoch’s News Corp, a longstanding megaphone for those intent on downplaying the risks of global warming. The corporate owner of Fox News and The Wall Street Journal has made a U-turn in its Australian publications, unveiling a comprehensive climate change campaign called ‘missionzero2050.’ It embraces the need to put “Australia on a path to a net-zero future.” Yet another sign of the times.

Back on home turf – or actually, just off shore – we’re also encouraged to see that the U.S. government is moving fast to scale up wind production. Following the big Martha’s Vineyard project we told you had been greenlighted a few months ago, the administration has now announced plans to open up almost the entire national coastline for commercial wind farm leases [paywall]. It’s a big deal: massive wind and solar deployment is America’s best bet with current technology to slash carbon emissions.

Innovation, of course, never stands still, and we are equally excited to see a surge of future-oriented projects taking flight. Some, quite literally. Examples are too numerous to list in this short newsletter, but here’s a sampling of just a few standouts that caught our eyes in October:

In anticipation of COP26, and to bring the global view down to the local level, Climate Central produced temperature projections to the year 2100 for 246 locations across the United States. This graphic compares a world where emissions continue on their current path and a world with aggressive emissions cuts that stay within the Paris Agreement limits of 2°C of global warming this century. The results show:

Dear Friends,

While it is always difficult to pare down the headlines we share with you, this month has been particularly challenging. From the deadly devastations of storms like Fred, Henri, and Ida to the flurry of activity leading up to the critically important United Nations climate conference starting next month, the news has been fast and furious.

The reality of climate change is setting in across the nation and around the world – thanks in part to the inescapable physical and economic costs that are becoming so apparent. But we are still divided on what we should do about it. Global leaders who recognize the magnitude of the challenge are facing tough choices, scrambling to implement policies that can both keep us safe and pass muster with their various constituencies.

The difficulty of transitioning is further exacerbated by the burgeoning global energy crises, as acute natural gas shortages and escalating prices harm people and economies across the world. There are many reasons for the shortage, but the public outcry could make it difficult for policymakers to deliver on carbon-reduction policies.

The next few months will be incredibly important, both on the domestic and international front, as nations and the international community wrestle with how to meet this challenge. Difficult choices lie ahead.

We can all help. Stay tuned, stay positive, and take action in a way that works for you and your family.

Wishing you well,

The C-Change Conversations Team

We loved this TED Talk about how fossil fuel workers and technology could help us lessen our climate risk by providing clean, geothermal energy all over the world. It seems fracking technology could enable us to dig deeper to capture the earth’s heat and transform it into energy we can use in many more places.

It reminds us, yet again, that there are many solutions unfolding, everyone must be invited to the table, and that we never know where tomorrow’s breakthrough may come.

Climate change has been almost everywhere this month, underscoring the stark truth that there is nowhere to hide. Hurricane Ida left nearly a million people without power in Louisiana and Mississippi amid hundred-degree weather that killed more than the hurricane itself.

Over 1,400 miles from Ida’s landfall, the storm dropped so much rain on New York and New Jersey that scores of people drowned in their cars and their homes. Tennessee also saw flash floods kill more than 20, while wildfires ravaged California – forcing thousands to evacuate Lake Tahoe – and yet another deadly heat wave took lives in the Pacific Northwest. All in all, the last few weeks have shown that the U.S. is not prepared [paywall] for our climate reality.

The millions who are directly affected by such climate-linked disasters are only part of the story. The economic fallout of climate change is also battering the finances of individuals, communities, and states far outside the direct line of fire … or the line of heat or water. In a game-changing move, the U.S. government is planning to pull back its subsidies for flood insurance policies in high-risk zones, setting the stage for premium increases for millions of homeowners, with potentially life-changing rate rises coming to tens of thousands. It’s a clear signal to those considering buying or investing in property at low-lying levels, but will hit those with nowhere else to go particularly hard.

Out West, a California moratorium has expired that protected fire insurance policies, putting their owners ‘at the mercy of the market.’ Millions more are at risk of losing policies this year as insurance companies and states try to retool a broken system that inadequately prices risk, leaving taxpayers to cover the real costs for people living in fire- and flood-prone areas. Change is unpalatable but a reckoning is clearly coming. And the cost won’t be measured by individual stress alone. Entire communities are facing insolvency [paywall] in the wake of climate-induced shocks, foretelling yet another body blow to small-town America.

If all this isn’t bad enough, the consensus of more than 230 medical journals is that a range of adverse human health consequences of climate change could be catastrophic if governments can’t manage to avert warming more than 1.5℃ above pre-industrial levels. This is particularly sobering since the United Nations warned this month that warming well above that limit is locked in – even if all the ambitious pledges to cut carbon are met by the global community. The UN says even if every country meets current emission promises, we will still experience a ‘catastrophic’ rise in global average temperatures of 2.7℃ by the end of the century.

In defiance of that alert, Australia’s government declared the country would continue mining and exporting coal well beyond 2030. Coal, of course, emits more climate-warming carbon into the atmosphere than other fossil fuels. Australia is the second largest exporter in the world.

Clearly, there’s much that keeps us up at night. And yet, many key countries are moving faster and better to get a grip on the climate crisis in the runup to the next UN Climate Conference (COP26) that opens on October 31. While Australia seemingly wants to put its head in the sand regarding coal, this month China made a major announcement to stop funding coal plants around the world.

And as if vying to take the lead after years of American reluctance to act, President Biden announced that the White House will work with Congress to double the administration’s climate finance commitments to $11.4 billion by 2024. Equally important, he asserted that this will enable developed countries to keep a key commitment to the world’s poorer nations to mobilize $100 billion a year to support climate action in the developing world. The failure of developed nations to honor that pledge has been seen as a potential stumbling block for COP26.

More applause is warranted for the recent joint pledge by the U.S. and the European Union to slash emissions of methane – one of the world’s most potent greenhouse gases – by 30% over the next 10 years. Seven other countries have signed on, promising an important collective initiative to dial back the source of about a quarter of global warming to date.

On the domestic front, the Environmental Protection Agency issued a new rule to cut the use of hydrofluorocarbons – a class of greenhouse gases that are hundreds to thousands of times more powerful than carbon dioxide and widely used in home refrigerators, air conditioners, and supermarket freezers. The bi-partisan support behind the plan to slash these super-pollutants is viewed as a major achievement.

Also this month, the Biden Administration announced that it will take immediate steps to protect Americans from extreme heat in the wake of a summer of lethal heat waves that killed hundreds of people around the country. Heat is the nation’s leading cause of weather-related deaths and the new initiative will involve multiple agencies.

Finally, we’re intrigued by news that the knowledge and technology behind the controversial practice of fracking (hydraulic fracturing) may power a shift to clean energy for oil companies and their workers.

This graph speaks for itself, showing the number of disasters costing $1 billion or more per year. Scientists say the rapid escalation in the number and severity of weather-related disasters is due in large part to climate change.

Dear Friends,

In these dog days of August, you may have missed the biggest climate news of the summer, or even the decade: the release of The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC). The title may be eye-glazing, but its conclusions are Earth-roasting. This report is a very big deal, with cause for both hope and concern. We’ve summarized what you need to know in our news roundup, below.

For those who prefer their own eyes to government reports or scientific data, however, the evidence of the past few months is equally devastating. At this writing, the Pacific Northwest – known for its temperate climate – is experiencing its second murderous heat wave [paywall] of the summer with temperatures widely topping 100 degrees. Just a month ago, Portland reached 116° and the town of Lytton, Canada clocked in at 121°– before it burned to the ground.

It doesn’t have to be this way. We can still change the future for ourselves and for generations to come, by caring about this issue, setting aside politics and raising our voices (especially with our elected officials), and recognizing and investing time and resources in good policy solutions.

The world is getting hotter. How hot is up to us.

With Determination,

The C-Change Conversations Team

The Intergovernmental Panel on Climate Change report “is a code red for humanity. The alarm bells are deafening, and the evidence is irrefutable: greenhouse‑gas emissions from fossil-fuel burning and deforestation are choking our planet and putting billions of people at immediate risk. Global heating is affecting every region on Earth, with many of the changes becoming irreversible.

The internationally agreed threshold of 1.5°C is perilously close. We are at imminent risk of hitting 1.5°C in the near term. The only way to prevent exceeding this threshold is by urgently stepping up our efforts and pursuing the most ambitious path.”

As the Wall Street Journal published on its front page [paywall], “The [IPCC] report reflects new scientific methodologies honed in an era of growing climate disturbances. It draws on a better understanding of the complex dynamics of the changing atmosphere and greater stores of data about climate change dating back millions of years, as well as a more robust set of satellite measurements and more than 50 computer models of climate change.”

The report is exhaustive and detailed, but its essential takeaways can be counted on one hand. The science on climate change is crystal clear and human-caused global warming is, indeed, accelerating. We’re on course to reach 1.5℃ of warming by mid-century with weather disasters and rising sea levels to increase with each additional decimal of heat. No place on Earth will escape the effects.

The good news is that the report says the world can still hold the line at 1.5℃. It will take unprecedented international effort and the wholesale transformation of our energy systems – but it is possible. How can it be done? One last IPCC takeaway may help. The report has gone on record affirming that the growing body of science linking climate change to specific extreme weather events is now robust and stronger than ever. Linking local calamities to global warming may be the best tool yet for raising calls to action.

As a case in point, a new analysis from the World Weather Attribution Network says the June heat wave in the Northwestern United States and Canada was “virtually impossible” without climate change. Even worse, the authors predict that heat waves like June’s – with temperatures of 116-120℉ – could occur every 5-10 years if the Earth’s current warming trajectory continues.

With sweltering temperatures again in August, it may seem that July offered a respite – but that would be a false impression. Across the globe, July 2021 was the hottest month ever recorded, according to the National Oceanic and Atmospheric Administration (NOAA). With this news coming just days after the IPCC report, NOAA underscored that the unwelcome new record was part of “the disturbing and disruptive path that climate change has set for the globe.”

All this comes against several disturbing background trends reported this month. First, the International Energy Agency said that global electricity demand is expected to surge this year as the world shakes off the COVID recession – with fossil fuels, particularly Asian coal, supplying more than half the increase. Renewable energy is also rebounding but not fast enough to offset the increase in fossil fuel sources and, as a result, the international community is slipping off its path to carbon neutrality.

The second gust of headwind comes from the Amazon basin – often called ‘the lungs of the Earth’ for its capacious, carbon-eating vegetation. A new study suggests that swaths of the rainforest are emitting more carbon than they absorb [paywall], under the dual assaults of deforestation and rising temperatures.

And third, there are increasing signs that the Atlantic Ocean’s current system – a conveyor belt that regulates the climate of Northern Europe may be demonstrating unprecedented weakening in the face of rising atmospheric temperatures. The system’s collapse would be expected to raise sea levels around the Atlantic and change both temperatures and rainfall on both sides of the ocean.

Against all the bad news in July and August, the hopeful steps towards climate solutions that we want to highlight may look small – even, in some cases, like double-edged swords.

Take Congress. We’re very encouraged to see two bills have passed the U.S. Senate with important climate initiatives intact. The bi-partisan infrastructure bill [paywall] includes about $130 billion for climate initiatives including ‘climate resilience,’ renewable energy, public transit and the largest ever federal expenditure on electric car recharging stations. A few weeks previously, the Senate overwhelmingly passed the “Growing Climate Solutions Act” to help farmers make money by selling carbon credits. It was a rare upswell in bipartisan cooperation around a climate solution proposal. We’re hoping these examples of bipartisanship in support of climate action will endure and expand in future legislation.

In response to the climate urgency, California regulators are once again in proactive mode – taking steps to alter state building codes [paywall] to require solar power and battery storage in new commercial construction and some large residential projects.

The move is one of many indicators that the economics around energy and climate are changing rapidly – even faster than many business leaders have anticipated. Another sign is in a recent S&P Global Market Intelligence report that the value of fossil fuels is declining as renewable energy deployment accelerates – and concludes some $68 billion in coal and natural gas investment may have to be written off as stranded assets.

Although we don’t relish the prospect of investors and shareholders losing money, we do applaud forewarning – and the drumbeat of evidence that smart money will be pursuing clean energy investments across economic sectors. We note with pleasure that the market for hybrid cars is booming – boding well for electric vehicles – and even lawn care operations in politically conservative areas are shunning gas in favor of electric power.

And if you don’t think that’s innovative enough, we leave you with this: researchers in Oregon are working to make marine algae (aka seaweed) the food source of the future. It absorbs carbon, it grows easily, and it’s nutritious. According to the ‘aquaculturists’ behind the idea, it even tastes like bacon when it’s smoked and fried.

As uncontained wildfires once again destroy communities in California, Canada, and Australia – even the Arctic is burning. Again. Hundreds died in Germany and Belgium last month as lethal flash floods linked to climate change overwhelmed some of the richest and most technologically advanced regions of the world.

Flooding in China killed even more people – some in an inundated city subway line. Watch the video taken by passengers who survived.

Dear Friends,

“Disruption” was the word-of-the-month for June. C-Change Conversations sees a warming globe as the biggest disrupter of all, with cascading effects from droughts and wildfires to disasters that are both economic and social in nature.

This year’s shockingly early extreme weather events are a case in point. After record temperatures and drought last year, the Western United States was again in the grip of an unprecedented heat wave by mid-June – barely the start of the 2021 hot season. It’s premature to blame climate change definitively. After all, mercury typically spikes in the summer. But with the Olympic Track and Field trials disrupted when the temperatures on the track measured 150 degrees in normally cool Eugene, Oregon, clearly something else was going on. To put it mildly, as NPR did, this is “not your average heat wave.”

The good news is that forces across the economy are responding with large and small disruptions of their own aimed at securing human safety, well-being, and economic opportunity. This month, we’ll brief you on a few big disruptive developments and also spotlight some mid-sized innovations with potential for big, positively disruptive payoffs.

As ever, we hope you’ll pass along anything you find interesting. And, of course, use the information to enrich your own conversations about climate change with friends, family, business associates, and community and political leaders.

Warmly,

The C-Change Conversations Team

“We find that millions are at risk … not years in the future, but this summer.

Behind the sizzling headlines about blistering weather is a disturbing pattern of ever longer, broader, and hotter American heat waves. And while we don’t know exactly how climate change is contributing to the intense heat in the Pacific Northwest, we do know it is having at least some impact.

Similar weather patterns, of course, are now being felt world-wide with direct and long-term implications for life-sustaining resources that will affect us all – but some of us sooner than others. The Northern Triangle nations of El Salvador, Guatemala, and Honduras – with high populations of subsistence farmers – have endured drought five out of the past ten years. The resulting food insecurity is considered a key factor in pushing some 300,000 migrants north to the United States each year [paywall].

Water supplies and essential food production are obviously the most critical vulnerabilities in the agricultural sector, but climate disruption is also affecting cash crops and products such as chocolate, coffee, wine, and beer. And, in a sign of the times, even salmon are struggling against drought. California’s Fish and Wildlife Service is planning to truck 17 million Chinook salmon downstream from their hatching areas in the Central Valley because their regular water routes to the sea have already dried up or become too heated for the fish to migrate on their own.

It turns out that NIMBYism thrives in unexpected corners. Local residents and environmental activists – who otherwise support clean energy – are disrupting utility-scale solar projects [paywall]. Their concerns – including aesthetics, landscape preservation, and endangered species – show that vexing tradeoffs on the road to carbon neutrality remain.

And in the category of not seeing eye to eye, we’re sorry to see a face-off brewing between Democratic municipal governments and Republican state legislatures over natural gas in private homes. As a growing number of towns and cities around the nation enact laws to prohibit or discourage gas-fueled cooking and heating, a growing number of states are passing laws to prohibit such legislation. The outcome of the battle may disrupt the utility industry and reshape domestic demand for natural gas [paywall].

The aforementioned face-off notwithstanding, the big news in partisan politics in June was the tiny crack in the polarization around climate change. Nearly one-third of congressional Republicans just launched the Conservative Climate Caucus, and others are readying to unveil climate policies of their own.

And in boardrooms and shareholder meetings, more and more of America’s investor heavyweights are pushing the climate agenda. “Wall Street senses a new climate [no pun seemingly intended] and is positioning itself accordingly,” writes Tim Quinson in Bloomberg. Hurrah! Black Rock and Vanguard, for example, are vocally happy to back shareholder initiatives to disrupt the status quo at companies like Exxon and beyond, though we observe a robust dose of risk analysis at play in their calculations, also.

June saw several disruptive legal and policy initiatives at the national and state levels. Let’s start with Belgium. In a landmark ruling, a Brussels court has declared the country’s failure to meet its climate targets breached the European Convention on Human Rights. It’s the latest legal victory against governments that have broken climate promises and could have international implications.

In more news from Brussels, the 27-nation European Union is reportedly preparing to impose levies on imported goods with high levels of “embedded” carbon such as steel, cement, and aluminum. The idea is to penalize countries with lower standards for carbon reduction as the EU tightens its own environmental rules and shoots for climate neutrality by 2050.

Closer to home, the state of California’s insurance regulator is endorsing sweeping changes to discourage new house construction in fire-prone areas [paywall]. The proposed changes are a bit wonky but important, with potential for disrupting the state’s real estate market and becoming a model for other states where climate change is making home insurance a lynchpin issue.

Finally, we’ll leave you with this: “ecocide” has been defined by a panel of 12 legal scholars from around the world as a new, international crime with intended equivalence to genocide. Although the declaration carries no legal weight at this point, it envisions prosecutions before the International Criminal Court in the Hague and is considered an important milestone in the campaign to prosecute individuals and companies responsible for severe and widespread or long-term environmental damage, such as extensive deforestation of the rainforest or the Chernolyl nuclear accident.

Carbon utilization – aka “carbontech” – is gaining momentum and even profitability [paywall]. Carbontech is a catch-all phrase for commercial products made with CO2 emissions captured from power plants or other sources. By one estimate, the international market for carbontech products could be nearly $6 trillion.

Researchers at the University of Cambridge have found a way to replace single-use plastics with a plant-based material they are calling “vegan spider silk.” The process reportedly is scalable, energy-efficient, and results in a “plastic-like free-standing film” which can even be composted at home.

And if that doesn’t excite you, how about solid-state batteries? As elusive as pixie dust, this long-promised technology could, among other things, double or triple the range of electric cars and reduce recharging times to a fraction of current requirements. Multiple companies are working on them, which means we should finally see solid-state batteries on the market in the next few years.

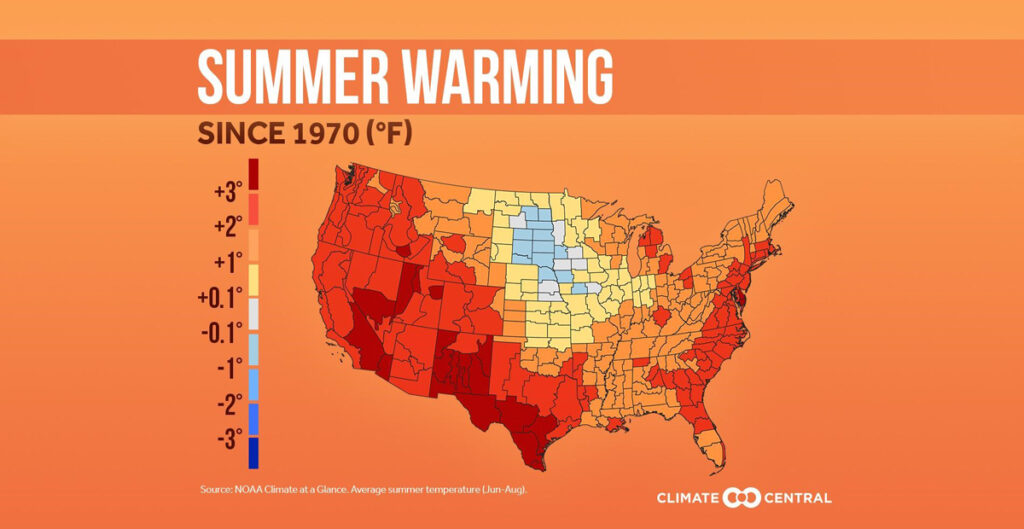

According to Climate Central, summers are getting hotter, and not just in the Pacific Northwest. In the past 50 years, 74% (179) of the 242 cities analyzed recorded an extra week or more of days with above-normal temperatures. The top 30 cities with the greatest increases, all recording a month or more of additional days above normal, were concentrated in the southern United States – particularly in the Southeast and Texas.

And areas on the map above that appear to be cooling during summer months? Those areas are still warming overall, but most of their warming signal shows up in winter. There is no definitive answer about the summer warming hole across the Upper Midwest/Northern Plains, but as Climate Central Meteorologist Sean Sublette wrote recently, “The early reasoning behind the cooling signal in the northern Plains is likely related to land use – there is now a greater coverage of corn and soybeans in the hotter months. Colloquially known as ‘corn sweat,’ the plants give off more moisture from their leaves … which leads to more evaporation, which has a cooling effect (like when you get out of a pool). But this is an area of active research.” To learn more, read Summer Climate Change in the Midwest and Great Plains due to Agricultural Development during the Twentieth Century (2019).